Apartment hunting can be a challenge, since you need a good credit score to quality (which your landlord will run a credit check on), and meanwhile you’re most likely going to be competing with others that also want the rental. If you’re waiting to boost your credit score, it’s likely that you’re going to be last in line since there’s others whose credit checks are approved, and the landlord won’t want to hold it for you.

Here’s the most efficient way to build your credit score to get rental approval and you’ll be looking for houses for rent in San Antonio in no time.

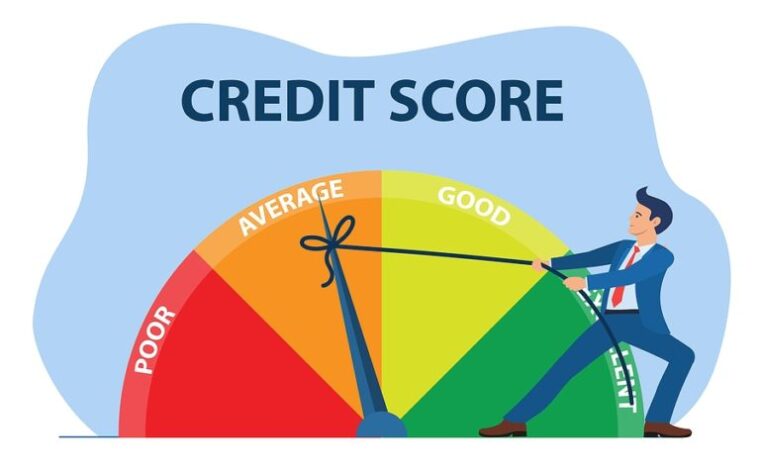

Pay Attention to Your Payment History

If you’ve been late in making credit card payments by less than 60 days once or twice, it’s not going to make a huge impact overall and send you into the deep end. It’s going to bounce back quickly once you make another payment on time. Although, it will take about five years for the entire cycle to balance out. If you are late making a payment by 90 days, that’s when things take a turn for the worse and drops your credit score. Plus, it will stay on your record for seven years minimum.

Look at Your Balances

You have a limit on all of your credit cards, and your total balance compared to your limit should be 30% or lower. If you have more than one credit card and their limits equal out to $50,000, your total debt for those cards should be around $15,000. If you’re paying the minimum amount every month and you have high balances, you should change it and pay the principal amount so your credit can increase more every month.

Length of Credit and Number of Credit Cards

How long you’ve had a credit card and the number of cards you have makes a big impact on your credit history. If you have a long credit card history, you’re most likely going to have a good credit card score. “Hard pulls” are when your information is used and pulled up everytime you apply for a loan or rental property which also has a negative impact on your score. Each time it’s pulled, the score will drop slightly. If it’s just one hard pull, there will be almost zero effect.

How to Fix Your Credit Score

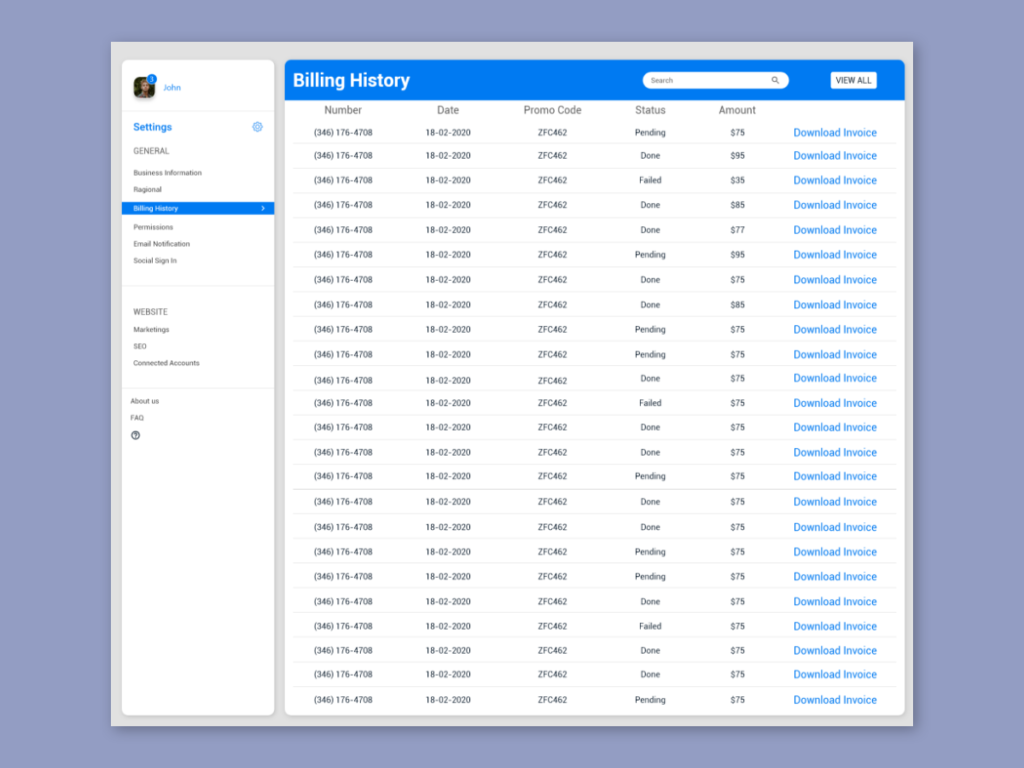

Having a credit score of anywhere between 300-600 is going to prevent you from being accepted for a rental property. The best thing you can do at first is to fix your late payments and make it your first priority to never miss a payment again. The next thing you need to do is pay down any high balances and debts, but don’t worry about any loans you have such as mortgage or student loans – these don’t impact your credit card score as they’re on an entirely different deal.

Have a Monthly Budget

If you’re finding it challenging to pay off high balances or even maxed them out, it’s time to make a plan and stick to it. Creating a monthly budget will keep you in the safety zone and help you to pay it down every month, therefore increasing your credit score. Keep track of when the payments are due and make a day to pay them, as well as paying more than the minimum amount.